I’ve been interested in how money works for as long as I can remember.

When I was 6 or 7 years old, I opened a passbook savings account with just a few dollars in it. I’d bring a quarter to the Savings & Loan, hand it to the teller, and they’d stamp my little blue book. Watching that balance grow, even by a few cents, was my first look at compound interest.

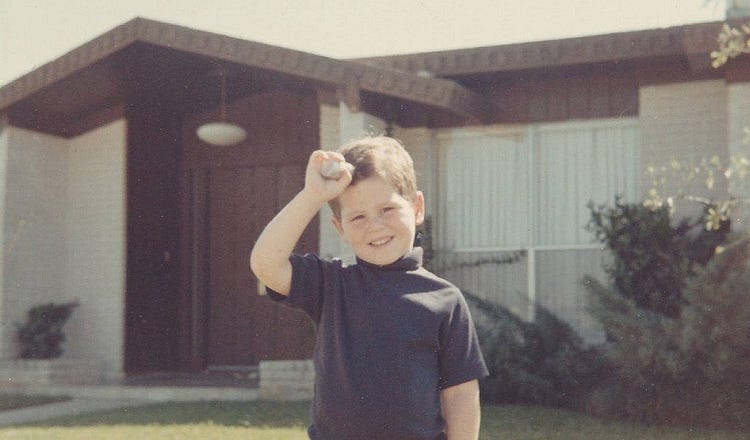

My mom was a stockbroker, and financial newspapers like The Wall Street Journal and Barron’s were always on the coffee table. Those conversations shaped the environment I grew up in. I’d take the bus downtown and watch the stock ticker scroll in office building lobbies. I tried out all kinds of little businesses—selling baseball cards and newspapers, fixing up PCs—just to see what worked and what I could learn.

Those early experiences shaped how I think about opportunity. Not just as something you hope for, but something you build toward. That’s what makes me excited about the Invest America initiative, and why my wife Susan and I are committing $6.25 billion through our charitable funds to expand its reach.

Starting next year, the U.S. Treasury will deposit $1,000 into an investment account for every child born in the United States. These accounts are tax-advantaged, structured for long-term growth, and meant to help children build financial momentum from the very beginning. Families can contribute, others can add to it, and by age 18, that account could help pay for education, job training, a first home, or future savings. It’s a simple idea, but a powerful one. Everyone starts with something. Everyone has a stake.