“It turned out that one of the biggest risks to our business model was catering to a very tightly knit group of investors who exhibit herd-like mentalities.” — Silicon Valley Bank senior executive

You are allowed to yell “fire!” in a crowded theater. Contrary to a popular myth, there is no U.S. law stopping you.

This past weekend, in our 21st-century theater—Twitter—economists and venture capitalists were screaming it at the top of their lungs, warning the rest of us about the meltdown of Silicon Valley Bank and the broader panic they were sure it portended.

Within 48 hours, the sixteenth largest bank in the United States (and the bank of choice for many tech start-ups) had been shuttered by the feds. Around $42 billion in deposits were withdrawn on Thursday alone.

SVB was the victim of an old-fashioned bank run. People—in this case, mostly companies—became nervous about the safety of their deposits and rushed to pull their money out. The bank, which had $210 billion under management going into 2023, saw $42 billion get pulled, unexpectedly, in a single day—more than $1 million per second.

Except it wasn’t exactly an “old-fashioned” bank run. House Financial Services Committee Chair Patrick McHenry called SVB’s collapse “the first Twitter fueled bank run.” In other words, this bank run was a particularly modern one—a panic aided by technology that has taken ancient human impulses and put them on warp speed.

There’s a decent chance that, were it not for a few tweets and a newsletter, SVB might still be serving customers today.

There were two signal events in the run-up to the bank run. The first was a tweetstorm posted in mid-January that called attention to a few red flags in the company’s finances.

It was right around that time—January 18—that more people in Silicon Valley began to talk (and text) about the bank. The tweets brought to more people’s attention what some had already known: SVB management had severely mismanaged interest rate risk by investing their ballooning assets (the bank saw huge capital inflows during 2021–2022) in long-term bonds, which lost significant value as the Fed hiked interest rates.

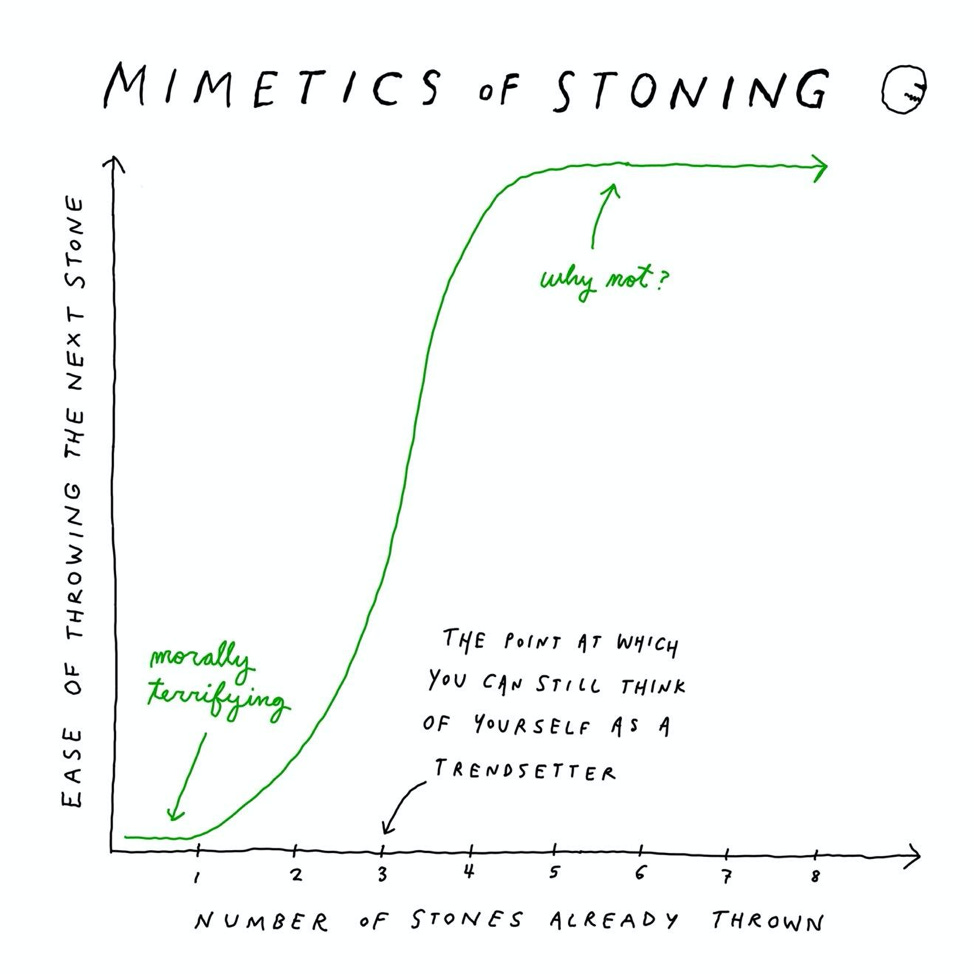

A month later came a post that went viral by Byrne Hobart, a financial analyst and writer in Austin, Texas, who writes a newsletter called The Diff. Hobart called attention to the bank’s highly levered asset base, and while he called a bank run highly unlikely, he noted: “No one wants to look paranoid by being the first to move their money out, but no one wants to deal with the consequences of being last.” Because a vast number of venture capitalists read the newsletter, it triggered deep concern among that cohort. (Several VCs pointed to this post as the triggering event.)

Within a couple of weeks after Hobart’s newsletter and tweet (which had 3.6 million views by the time of this writing), some highly influential venture capitalist firms, like Peter Thiel’s Founders Fund, were advising portfolio companies to pull their money out of the bank. And unlike in 2008, when Bear Stearns and Lehman Brothers collapsed, SVB’s depositors could withdraw that money in mere seconds from their phones.

“It turned out that one of the biggest risks to our business model was catering to a very tightly knit group of investors who exhibit herd-like mentalities,” stated a senior executive at SVB last week, trying to deflect the blame. Bloomberg columnist Matt Levine put it even more bluntly: “Also, I am sorry to be rude, but there is another reason that it is maybe not great to be the Bank of Startups, which is that nobody on Earth is more of a herd animal than Silicon Valley venture capitalists.”

No one is an easier punching bag than denizens of Silicon Valley, but to scapegoat any single one of them, or even a small cohort of firms, is naive. The truth is that the Silicon Valley folks are no more or less herdlike than the rest of us—especially when armed with Twitter. Indeed, what nobody at Silicon Valley Bank seemed to have realized is that social media is a superconductor of mimetic contagion—the spread of ideas and desires in mere seconds—unlike any the world has ever seen. And our institutions are no match against it.

The social theorist René Girard (who is gaining more attention these past couple of years, with his main idea, mimetic desire, even getting mentioned in the hit show The White Lotus) has shown that humans are extraordinarily powerful and sophisticated imitators. And the speed and force of that imitation increases dramatically at times of uncertainty.

There is an instinctual response at the most basic level: stampedes are created when people see other people running, and they don’t give much thought about why. We don’t think of Twitter like a stadium in which we can easily be trampled, but it is not too far off.

I was on Twitter a lot between Thursday and Saturday—just as the SVB story was gathering steam. Even while I was nestled away at a quiet lake house in Michigan where nobody around me seemed concerned about anything other than walking their dogs, I had visions of block-long lines at my local, regional bank and dozens of others around the country based on a handful of tweets from highly visible people warning of the coming deluge. It seemed like the next worst thing to the zombie apocalypse was about to happen—and I haven’t even finished watching The Last of Us.

The key to understanding how mimetic contagion works is the power of suggestion. As Iago demonstrated in Shakespeare’s Othello, it is only the mere suggestion of infidelity that sets off a string of reactions. It is the suggestion that someone is racist or x-phobic that causes extreme emotional distress—and many times real-life consequences. It is the mere suggestion that something that is or would normally be a minor risk which has the power to amplify that same risk and set off a reflexive process whereby perception becomes reality.

There are people who woke up on Thursday or Friday morning with deposits in SVB who withdrew their money in a panic—but the thought of doing that would never have crossed their minds had it not been first suggested to them on Twitter or by email or text. The power of suggestion cannot be overestimated.

In other words: the mimetic contagion has epistemic consequences. Being caught up in the process changes how we see reality. And it takes only a mere suggestion by the right person to put a panic into motion, one person at a time. It doesn’t matter whether the suggestion turns out to be true or false, or even the motivations of the person who made it. The effect is the same.

This raises a serious ethical question. Let’s say you are a sharp venture capitalist and you believed that SVB was in deep trouble. Was the right thing over the past few days to take to Twitter and warn people in order to protect them—and pressure the Fed to intervene? Or was the right thing to remain silent in order to prevent a bank run that perhaps might not have happened without social media?

Almost immediately in this case—and this is another core idea of Girard’s—those that did move quickly, like Thiel, were scapegoated for doing so.

When it comes to these destructive mimetic cycles, it can seem like there are simply no good options. We’re damned if we do, damned if we don’t. It’s a strange dilemma.

All of us have the right to speech—and certainly ethical and financial obligations to our own companies and those we are invested in. I tend toward free speech absolutism, including on Twitter. But it’s important that we each also understand ourselves as players in a giant mimetic machine, capable of becoming a model for others to follow.

Many have diagnosed what happened at SVB with keen financial insight, and many more will continue to do so. They will make important policy proposals and strategy decisions related to our banking system. (Others not so much: “Don’t trust banks, trust Bitcoin” is a meme that took only a few seconds to emerge. The crypto crowd never misses an opportunity.)

I will leave such analysis to others. Given that we can’t avoid the mimetic social process that contributed to the problem, what are some anti-mimetic tactics we can introduce in order to make such panics less common, and less severe?

The answer is not restricting speech or the ability of people to have access to their money when they want it; both of those approaches would do serious violence to our freedoms, and would open the door to more. But we have other options.

First, we should implement intentional braking mechanisms on the processes that are unleashed when there is runaway mimesis—people reacting to other people reacting, and then reacting to the news about other people reacting (making everything doubly mimetic). Our technology has removed almost all friction from bank runs, and that’s a dangerous situation. We must reintroduce friction. We have to find a way to slow things down.

If Tesla vehicles already contain a technology as cool as regenerative braking, then I’m confident we can find a way to put some form of braking mechanism on our social media platforms in order to slow the spread of dangerous contagion until people have had a chance to cool their heads and more objectively evaluate what’s going on. This weekend it was a bank run. Tomorrow, it might be panic over the threat of a nuclear strike.

The stock market has “circuit breakers” that are triggered when the market drops by 7 percent or more in a single day; they halt trading for a certain period of time so that market participants can let the fog of war clear. As far as I know, no such similar mechanism exists on social media during times of crisis, which are states of exception. But what if it did? One such rule might be an “Are you sure?” message prior to executing a potentially damaging or inflammatory retweet, even for tweets that do not include article links as Twitter currently does. The extra one to five seconds is not trivial during a mimetic crisis.

Second, we need leadership that knows how to move at the speed of the internet. Time matters because mimesis accelerates and compounds. I’m grateful that the Treasury and Fed guaranteed deposits on Sunday afternoon (this is very different from “bailing out” Silicon Valley Bank, by the way—it simply means that depositors won’t lose their money). I only wonder what may have happened if this were announced earlier, without the 48-hour panic before the statement. Institutions and institutional leaders need to adapt to the new, hyper mimetic world that we live in, where contagion is only a tweet away. Silicon Valley Bank will not be the last of these incidents. The depositor guarantees simply bought us some more time to find real solutions.

The third solution is the hardest but most important. The late writer David Foster Wallace once said that we’re going to need to “develop some real machinery inside our guts” to help us deal with this. He was speaking about the dangers of technological advancement hijacking humanity—things like the development of virtual reality pornography that would travel to the very bottom of our brain stem and overwhelm us.

It takes guts to demand that people warning of severe danger during the SVB crisis disclose their positions so that the motivations behind potentially inflammatory communication, which has the potential to incite action, can at least be parsed.

It also takes guts to simply log off. The vast majority of us had absolutely no direct exposure to Silicon Valley Bank, but many people (myself included) were caught up in an unhealthy curiosity—like rubbernecking at the scene of an accident on the side of the highway. If we can do absolutely nothing concrete to help, and if we can contribute nothing of substance, it might be better for us and the others involved if we considered just going outside.

The financial journalist Jason Zweig once wrote: “Bubbles are neither rational nor irrational; they are profoundly human, and they will always be with us.” I believe the same is true of bank runs. There may be nothing we can do to completely prevent them, short of authoritarianism or a complete reform of the banking system. Humans run. We always will. But the technology that has transformed all of our lives seems to be making it more likely than not that we’ll accidentally run off of a cliff.

Luke Burgis writes The Anti-Mimetic Newsletter and is the author of Wanting: The Power of Mimetic Desire in Everyday Life.

If you’re hungry for more smart takes on the news, support our work by becoming a subscriber today: